2020 Trends for Computer-Aided Design (CAD)

This post is one part of G2's 2020 digital trends series. Read more about G2’s approach to digital transformation trends in an introduction from Michael Fauscette, G2's chief research officer.

Emerging 2020 trends in computer-aided design (CAD)

From 3D design, to the introduction of cloud-based CAD, computer-aided design (CAD) has gone through countless changes since its inception in the early 1960s. Now, the industry is poised for another revolution.

With generative design, real-time simulation, augmented reality (AR) software, IoT platforms and the major shift to SaaS, the computer-aided design industry is experiencing a resurgence that will influence many business functions in the near future.

This article will provide a high-level summary and predictions about computer-aided design trends. In the coming weeks, a new article will be published with an in-depth analysis of each trend.

CAD products are shifting towards SaaS models versus one-time purchase models

In 2015, Autodesk announced they would stop selling stand-alone licenses in favor of a SaaS model. In the first year of selling SaaS only products, Autodesk suffered a loss of almost half a billion dollars, devaluing from $2.5 billion down to $1.95 billion.

These losses led the public to believe that CAD users only wanted on-premise solutions, and that Autodesk was tanking. However, Autodesk started to gain traction again in 2017 and posted massive annual gains. Now they sit at a revenue of 2.9 billion and are absolutely thriving using the SaaS model.

CAD continually shows signs that the market is shifting away from perpetual licensing models, and towards SaaS. 2019 confirmed this trend when major industrial IoT vendor PTC acquired SaaS based CAD solution Onshape. With the purchase of Onshape, PTC will create a SaaS platform that combines CAD, data management and collaboration tools.

This move was likely sparked by other major vendors in the CAD market—Autodesk, Dassault Systemes, and Ansys—experiencing strong momentum due to the SaaS model. PTC even commissioned a market study from McKinsey that projected the SaaS-based CAD market would grow 35% annually, and represent nearly 20% of the total CAD market in five years.

That’s a massive projection that’s supported by even more data. When Autodesk made the transition to a subscription model, they converted about 4.3 million customers to a SaaS model. While this number sounds huge, there are still 18 million active users of their software. That means 14 million users actively use Autodesk's products without the SaaS model. This presents a massive opportunity for Autodesk to convert more customers, and creates a chance for other CAD vendors to poach them away. Vendors like PTC understand this, justifying their massive $470 million purchase of Onshape.

As this trend proliferates, users will see the many benefits of SaaS. Some of these benefits include support for many types of devices, ease of setup, seamless collaboration capabilities, automatic patch updates, no file servers, and no additional software.

Product development teams are wasting time with on-premise solutions where users spend hours copying over thousands of files. This is especially wasteful in an industry like CAD.

At G2, we expect 2020 to be a big year for SaaS-based CAD.

Companies are adopting cloud-based CAD at higher rates

The CAD industry is one of the final markets embrace cloud-based solutions over on-promise solutions.

For years, we’ve heard users cite reasons such as annual subscription fees, needing internet access, lack of storage, and network security concerns. Yet, even if users resist the cloud, major vendors are the biggest roadblock to widespread adoption.

For years, we’ve heard users cite reasons such as annual subscription fees, needing internet access, lack of storage, and network security concerns. Yet, even if users resist the cloud, major vendors are the biggest roadblock to widespread adoption.

This past year, Dassault Systemes announced major updates to their cloud-based platform SolidWorks xDesign. The platform was built to operate in the cloud and is intended to increase collaboration between designers and product managers. Aside from this, users already know Autodesk offers a hybrid on-premise/cloud-based solution with Fusion 360. This software caters to users that want to leverage cloud software.

No development is more interesting in CAD than PTC’s recent purchase of cloud-based software vendor Onshape. Although we already predict that this would affect the SaaS CAD market, it may also have major implications on cloud-based CAD.

Perhaps no one believes in the power of the cloud more than one of the most innovative and experienced contributors in the history of the CAD industry: Jon Hirschtick.

Jon Hirschtick was the former founder and CEO of SolidWorks, before he left to create Onshape in 2012. Seven years later, Onshape is now part of PTC and Jon Hirschtick is doubling down on his faith in cloud-based CAD.

Cloud-based CAD has been slow to adoption over the years, but more vendors will start offering subscription-based cloud CAD solutions in addition to their on-premises solutions. While some CAD vendors are hesitant to switch, fearing their cloud-based solutions will cannibalize their on-premises solutions, it’s preferable to other vendors stealing their customers.

At G2, we expect the next couple of years to be big for the cloud-based CAD trend.

There has been more use of automation in the CAD industry

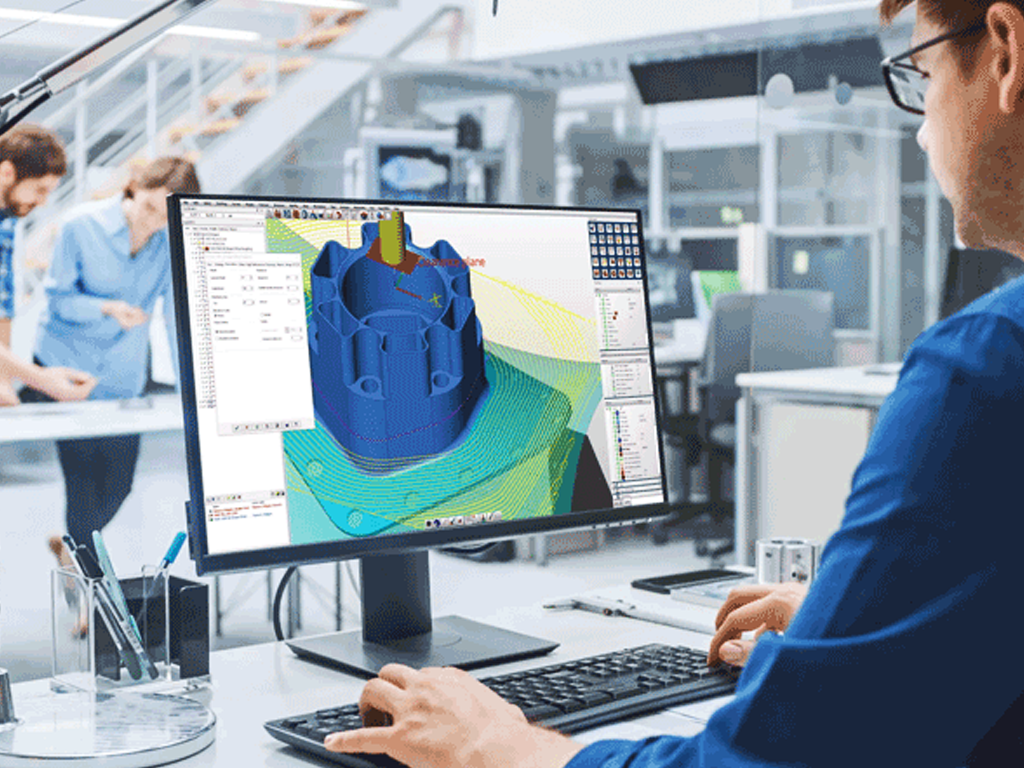

Automation is penetrating almost every market across software, and computer-aided design is no exception.

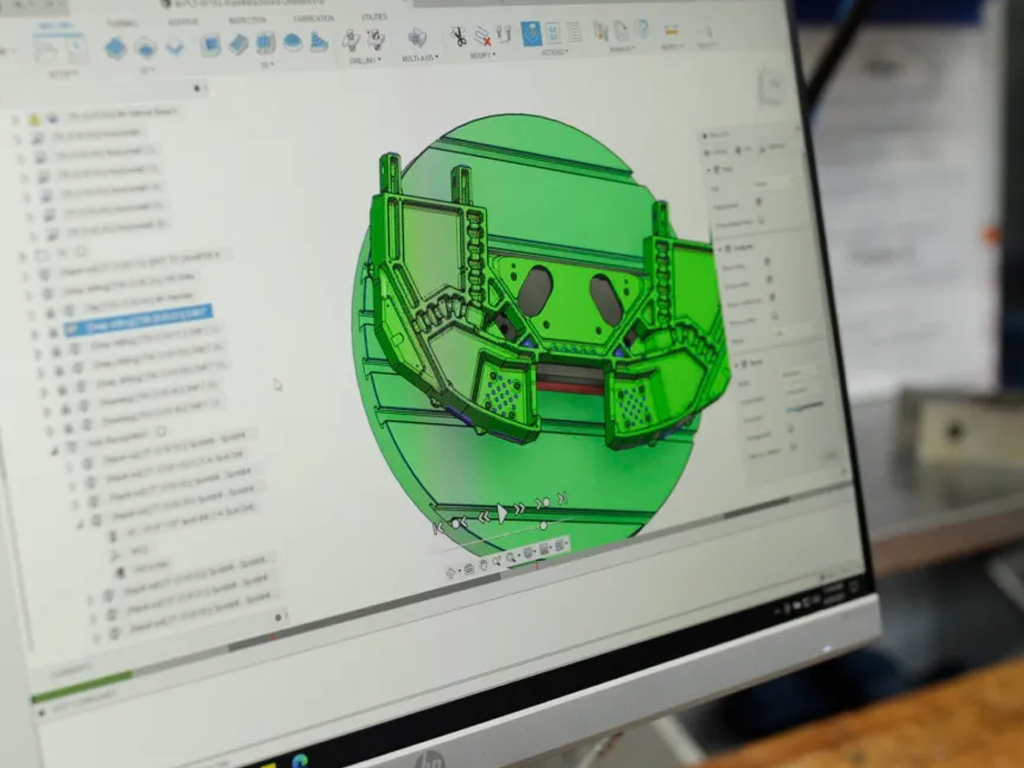

One of the major trends in CAD automation that continued to gain steam in 2019 was generative design.

Generative design combines artificial intelligence (AI) and machine learning to generate countless design iterations. Users input design goals into the software, along with parameters such as performance, spatial requirements, materials, manufacturing methods, and cost constraints. The software explores all possible variations of a solution and quickly generates design alternatives. It tests and learns what works, and what doesn’t, from each iteration.

Many CAD vendors in 2019 added more functionality to their pre-existing generative design features. Siemens added significant updates to generative design capabilities in Solid Edge 2019, while both Autodesk and SolidWorks announced improvements to their generative design tools in Fusion 360 and SolidWorks 2020.

PTC acquired generative design software Frustum in November 2018. This strategic move allows them to stay ahead with innovation in the CAD market. Additionally, Autodesk announced a collaboration project with Hewlett Packard Enterprise (HP) to create generative design software tools that work directly with printers.

While some of these generative design developments will provide benefits to a variety of industries, there have already been plenty of companies that have utilized generative design.

One of those most famous case studies from generative design was airplane manufacturer Airbus. They used generative design to redesign the interior of an A320 aircraft. The new design they created used significantly less material and weighed 45% less.

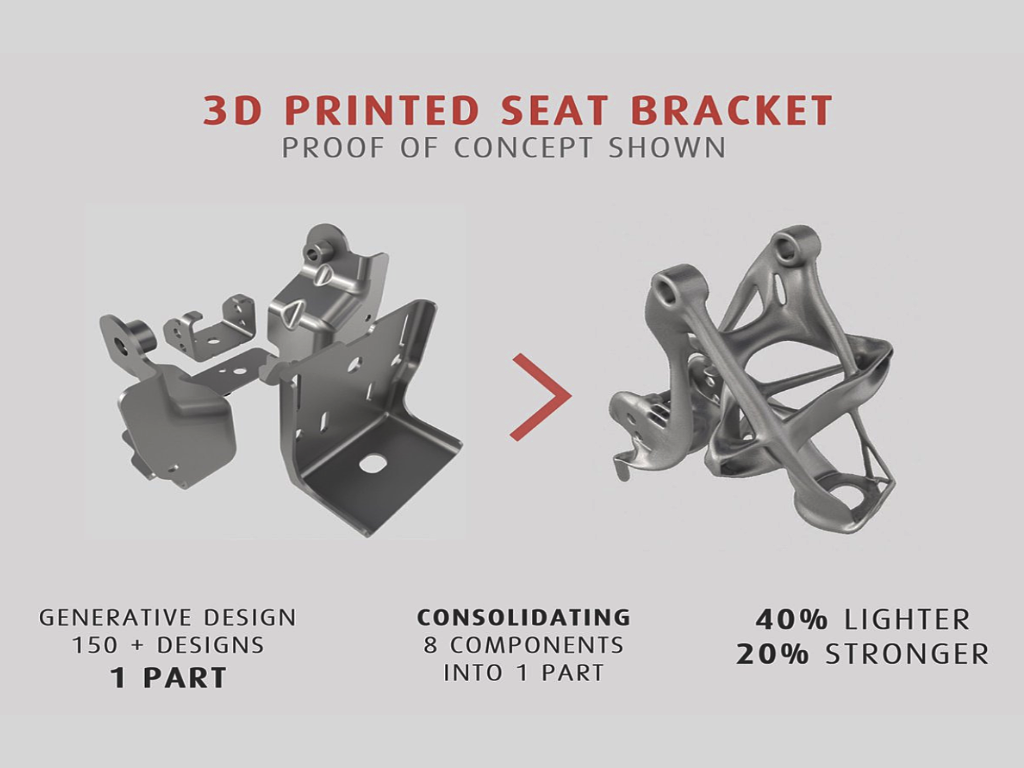

Another significant case study featured General Motors’ 3D-printed stainless steel seat belt bracket. Generative design software helped create a seat belt that was 40% stronger and 20% lighter than the original version.

In 2018, the generative design market was valued at $137 million; this is expected to more than double in the next five years to $290 million. Additionally, only 46% of design firms are aware of generative design tools and only about 37% currently use them, according to a generative design report from Autodesk.

As more generative design specific software arises from advancements in machine learning and artificial intelligence, we expect the market to grow.

One of the most exciting trends in the design world is the increased adoption of 3D laser scanning in building information modeling (BIM) software.

To use 3D laser scanning, users set up a scanner on a tripod to capture the dimensions of a physical space. Once the tripod is set up, the 3D laser scans the area and digitally captures the shape of physical objects using a line of laser light. Once it captures this data, the 3D laser scanner imports it to BIM software to create an accurate representation of the space. This process is known as “scan to BIM.”

2019 was a big year for “scan to BIM” as vendors introduced new developments in this technology; overall, technology is more important to the architecture, engineering, and construction industries.

2019 was a big year for “scan to BIM” as vendors introduced new developments in this technology; overall, technology is more important to the architecture, engineering, and construction industries.

On the software side of things, major CAD and BIM vendor Bricsys announced a new research collaboration with Leica Geosystems (also part of Hexagon) and HOK, the United State’s largest architecture firm, to advance scan to BIM technology. The collaboration aims to make the technology even more accurate by automating the conversion of point clouds into solid geometry.

In addition to software and hardware developments, there are now so many affordable options are on the market. While high-grade 3D laser scanners range from $100,000-$200,000, some high-grade lasers sell for as little as $35,000; some mobile laser scanners cost as little as $1,000. The accessibility of this hardware is a huge step that will affect the entire market.

When you couple the software and hardware developments with the lower cost of the hardware, the 3D laser scanning market is poised for major growth in the coming years. As a result of this growth, we expect the BIM market to reap the benefits of this technology and continually introduce more software compatible with 3D laser scanning.

According to a Grand View Research report, the global 3D scanning market was valued at $4.5 billion in 2018; it’s projected to expand at a CAGR of 8.4% from 2019-2025.

At G2, we think this is a conservative estimate and expect this number to be closer to 15% over the next year.

More companies are utilizing VR BIM

Although VR BIM has been around for almost five years, incremental updates, especially in the past year, have created a dynamic and useful tool for architects and designers.

Historically, VR BIM was rudimentary and only allowed users to view the basic layout of a building’s space. However, as VR BIM has improved, users can now collaboratively edit the building design within the virtual reality space and render natural elements such as water and airflow.

This past April, InsiteVR launched an integration with Autodesk's BIM 360 construction management platform. The integration allows users to host virtual meetings and design review using BIM 360 data. Clients can enter the virtual reality space with architects and make suggestions to achieve their vision. This helps designers create transparent vendor-client relationships.

In August, IrisVR introduced its first stand-alone VR solution for AEC professionals with Oculus Quest VR headsets. Prior to this, users needed a direct connection from their VR headsets to a computer or external sensor. With Oculus Quest, users can remotely connect, this allows them to explore their designs without the restraints of a computer nearby. G2 reviewers seem to be love this update, some even cited how it’s won them projects.

Speaking of winning projects, there seems to be an increase in project tenders that require VR to be adopted. For businesses pitching projects to clients, not having VR puts them at a huge disadvantage.

Google trends indicate that countries like Singapore, Sweden and Finland have expressed major interest in virtual design and construction. These countries already require BIM in their project tenders, so it would seem natural for VR BIM to be the next step.

Companies in the past year have communicated the ROI VR BIM has provided throughout the construction process. In a case study from Anglian Water, the vendor noted how they were quickly able to identify construction issues using VR BIM. During a VR inspection they noticed a chemical injection cabinet was placed too low in the environment.

With the major developments we’ve seen in the past year, G2 believes the trend of VR BIM adoption will increase 100% in the construction and engineering sectors, and at least 15% in the next year alone.